As I have said in many of my previous blogs, I am still pretty new to the Oil & Gas industry. Even though I have been at CROFT a little over two years, I didn’t get to enjoy much of the industry before it took a turn downhill. Nowadays, it seems most conversations I have on a day-to-day basis entail the market, as to when it will come back, and how companies are surviving in the meantime. Peppered into these conversations is discussing how this downturn differs from previous crashes. So naturally after a while, I got curious. When did these other crashes happen? What was the price of oil? How long did the downturn go on for?

Since OPEC formed, the oil industry has faced three major crashes.

The Fall of the 1980s

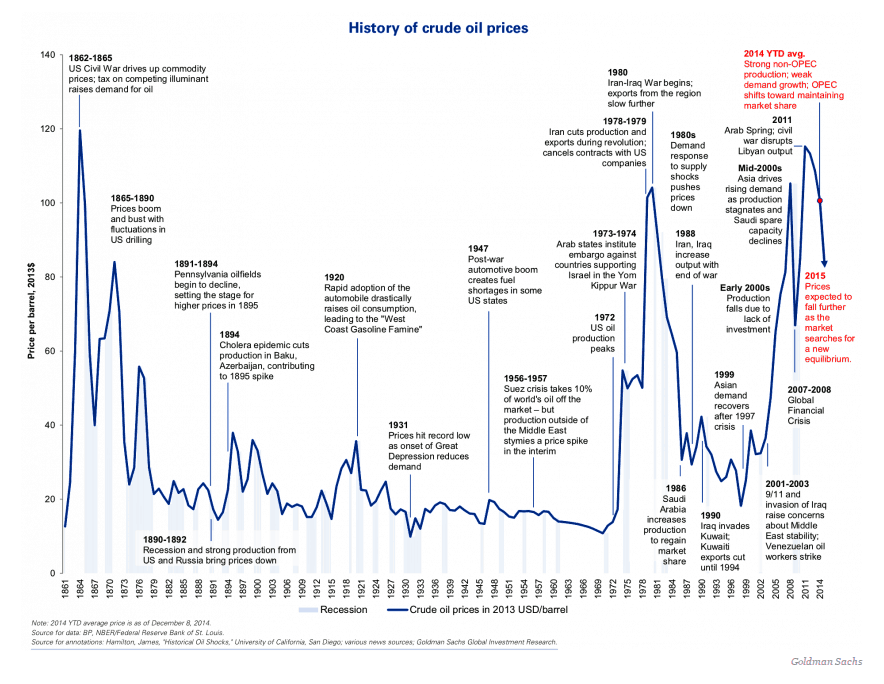

The first crash came in the mid-1980s and it was anything but a short one. In 1980 the price of oil had reached a peak of over $35 a barrel. I know this price doesn’t seem like a lot but this is equivalent to $101 per barrel today. The reason for the high price was because of slower economic activity in industrial countries and energy conservation due to high fuel prices. After 1980, prices began to fall with reduced demand and increased production. Over a 6 year decline, the oil price went from over $35/barrel to below $10/barrel.

In the U.S., production, and exploration drastically declined. In 1985, there were almost 2,300 oil rigs that were actively drilling. Only a year later, the count had dropped to about 1,000 rigs. Oil producers severely cut back the search for new oil fields and stuck to concentrating on the investments they had….sound familiar? The number of producers themselves also decreased. In 1985 there were 11,370, and in 1989, the number dropped to 5,231. 1986 was marked at a record low, and prices only began to slowly rise until the year 200?.

The Second Crash of 2008

The oil market crash in 2008 didn’t last as long as the one in the 1980s. This crash was due to a decrease in demand. By the summer of 2008, the oil prices were over $100 a barrel. Then the Great Recession happened… Oil prices quickly dropped to below $40 a barrel. According to Fortune, “this sharp drop in demand was transient: China’s fuel needs continuing to surge, and recovery started in the advanced economies, reviving their fuel demands.”

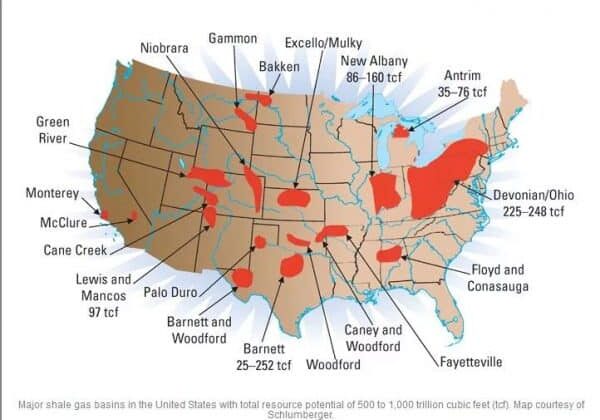

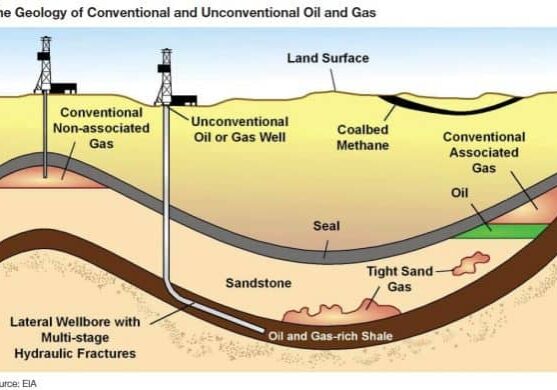

Increasing production in the shale industry contributed to added global oil supply. The end of this crash came quickly as prices began to quickly rise again. In 2012, the prices were over $100 a barrel again. As we know, this price remained steady until today’s crash.

Which brings us to today…

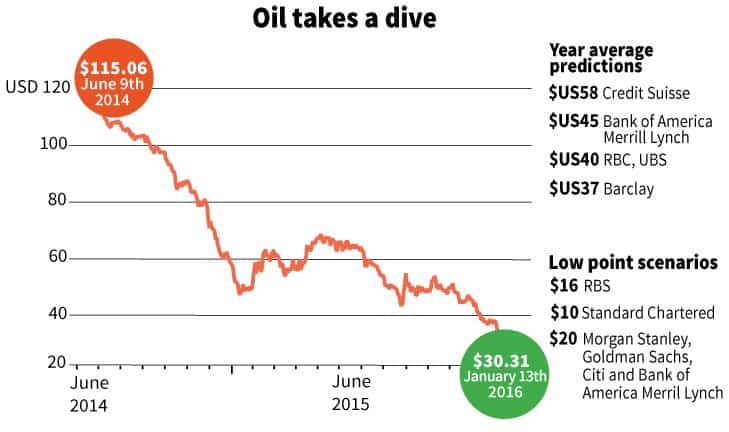

How long will this market crash last? Short lived like in 2008 or years-long like in the 1980s. If you simply take search on the internet for how long this market crash will last, you will find many different answers and opinions. The truth is, no one really knows.

What is the cause of this downfall, you ask? For one, there is too much supply. U.S. shale production has proved continuous shale growth and non-OPEC countries have led to excess capacity due to oil exports. Of course, following increased supply is a decrease in demand. Along with the big obvious of supply and demand, there are other factors, including the rise of the U.S. dollar value, and of course, Saudi Arabia not willing to cut production. All of these factors have led us to where we are today. The prices have taken a huge fall…from over $100 to below $40 a barrel. Producers have cut back, companies have merged, and many are just concentrating on protecting their investments.

There are still some drilling projects and continued production occurring. Given the down market, CROFT is here to help continued production on the well sites. We strive to reduce our client operating costs and can resize current equipment or upgrade clients to more efficient units. If you are interested in seeing what we have to offer and checking out our pricing, please reach out to us!