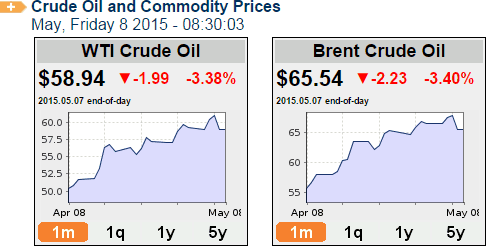

The naysayers have been quiet this week. The price of a barrel of oil has grown almost $15.00 a barrel in just one month. GREAT NEWS for my state’s economy and for the industry that supports my growing family. However, it’s not all peaches and cream. There are still lots of marginal sized companies barely hanging on. Remember that old poster your elementary school teacher had with the kitten dangling on a tree branch motivating you. I have a feeling that is what quite a few companies keep telling themselves every day when they start their workday. These producers are hoping that the worst has weathered and they are doing what they can to hang in there as they wait for the upturn once again.

Unfortunately no amount of daily affirmations have been able to save some oil and gas wells. Of course, oil and gas production is still going on…but rig counts are down. The proof is in the pudding.

Average International Rig Counts:

- April 2015 was 1,202

- Down 49 from 1,251 in March 2015

- Down 147 from the 1,349 in April 2014

Average United States Rig Counts:

- April 2015 was 976

- Down 134 from 1,110 in March 2015

- Down 859 from the 1,835 in April 2014

Average Canadian Rig Counts:

- April 2015 was 90

- Down 106 from 196 in March 2015

- Down 114 from the 204 in April 2014

Thanks Baker Hughes for all the great data!

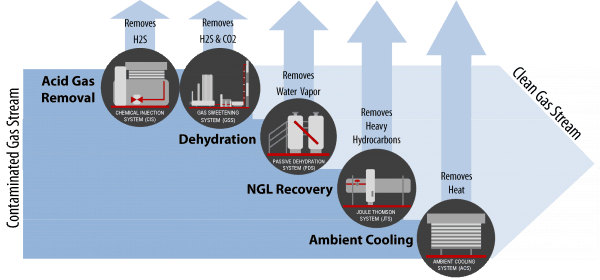

So what are some of the smaller oil and gas producers doing to not shut down production in the current market? It is all about re-evaluation. Companies are evaluating at all aspects of themselves to see what can be done better. Well, not just better but more efficiently. The old adage, “If if ain’t broke don’t fix it” is not acceptable anymore. A companies processes may not “be broke” but it can be inefficiently and costly. And THAT is a huge factor in what is causing marginal wells to shut down. Spending a small amount of capitol up front on more effective equipment can save you a bundle of money during the tight times. Companies that are using progressive thinking and have implemented this are still going strong right now, and they are well prepared to ride out the lower oil prices.