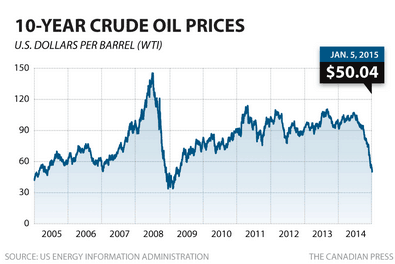

Maybe it is just because I am in the industry but talk of crude oil prices are the talk of the town. Even if you have nothing to do with the industry, I am sure you have heard about it one way or another. Whether you heard about layoffs or low gas prices, the low price of oil has affected everyone. So let’s talk about the oil and gas companies themselves. How are they surviving this? What are they doing or sacrificing to keep being a profitable company?

First off, at what point will producing oil not be profitable?

According to CNBC, even if the price of oil dropped to $40 a barrel, only 1.6 percent of oil supply in the world would signify production unprofitable. However, different producers are profitable at different prices. U.S. onshore production of smaller wells that produce a few barrels of oil a day would be the first to go. Their production cost varies between $20 and $50 per barrel so if the price drops below $40, then some of those producers may stop pumping.

Next would be from Canadian tar sands fields which start to lose profit when the price per barrel hits the high $30 range. Interesting fact though, they use a lot of fuel for production and is a major cost so lower oil prices could actually help their overall costs.

The U.K. starts to become unprofitable when the price hits below $50 a barrel. But according to CNBC, many of them are older fields coming to the end of production so if they were to stop production then it could mean slowing down for good.

So overall, the impact on global production of the price of oil reaching $40 per barrel would be small. To reiterate from above, if the price reached $40, 1.6 percent of the global supply would be unprofitable. The main contributors of oil would be the United Kingdom and the United State while seventeen countries would be not be profiting at $50 a barrel.

Just because a field becomes unprofitable, it doesn’t necessarily mean that producers need to shut down production. They have a decision to either continue production and just eating the costs or to halt production which would in turn reduce their supply. So naturally, producers try to cut costs anywhere else.

Cutting Spending, Layoffs, Holding Investments…

The big elephant in the room is layoffs in the industry. In order to continue production while remaining profitable, companies have had to cut costs by shutting down or decreasing wells resulting in layoffs. Every week I am getting an email or discussing with coworkers about another big oil company making another round of cuts. According to Forbes, the oil and gas industry has laid off $75,000 and counting worldwide so far out of the 600,000 that work in the industry.

The industry is cutting spending, delaying investments, and putting projects on hold. At this point companies are playing it safe and not spending more than they have to unless it will prove profitability. Top oil producers are cutting their spending plan by sometimes more than 30%.

Even though companies are remaining profitable at $56 a barrel, they are playing it safe and cutting costs where necessary and optimizing their wells sites until the demand for oil catches up. If you haven’t already, check out Amy’s blog discussing the Crude Oil Export Ban and how this could affect demand increasing in the industry. Now is the time to reevaluate cost structures and learn how to come out of this slump bigger and better. Companies are going to profit most where they can. For example, companies wanting to make profit off of the stranded gas coming from their wells. Why not treat the stranded gas in order to make money off of it?

Not to put a damper on your day, but this is what is in the news all around us. And myself being in the oil and gas industry, this is something I find very important to stay updated with. The prices will rise again but in the time being, this is the time that industries are optimizing costs and learning for the future.

Check out CROFT’s gas processing equipment.

http://www.cnbc.com/id/102326971

http://www.forbes.com/sites/christopherhelman/2015/03/16/oil-layoffs-itemized-75000-and-counting/

https://www.nasdaq.com/market-activity/commodities/cl%3anmx

http://www.bloomberg.com/news/videos/2015-02-25/when-will-oil-companies-cut-production-